Download Rent Receipt Format Word

What is a Rent Receipt?

- Cash.

- Credit and Debit card.

- Physical cheques.

- UPI, NEFT, RTGS, and IMPS.

Maintaining a record can be challenging when payments are made via cash or cheque. Vyapar simplifies this process by offering a rent receipt maker app that allows you to create receipts, securely store transaction details, and generate backups for added security.

Conditions for Tax Exemptions Under HRA

Section 10(13A) of the Income Tax Act mentions that only part of the HRA is taxable. It means that, unlike an employee’s salary, the HRA is not fully taxable.

To avail of the tax concessions under HRA, a person has to fulfil these conditions:

- They should be a salaried person.

- Employees should receive HRA as a part of their salary package/CTC.

- The employee should be living in rented accommodation.

After fulfilling these conditions, the person must submit a rent receipt and the rent agreement between him and his landlord. In cases where the rent crosses the line of ₹ 1,00,000 annually, the PAN card or the owner is also required. All these documents should be submitted to the employer to avail of the tax benefits.

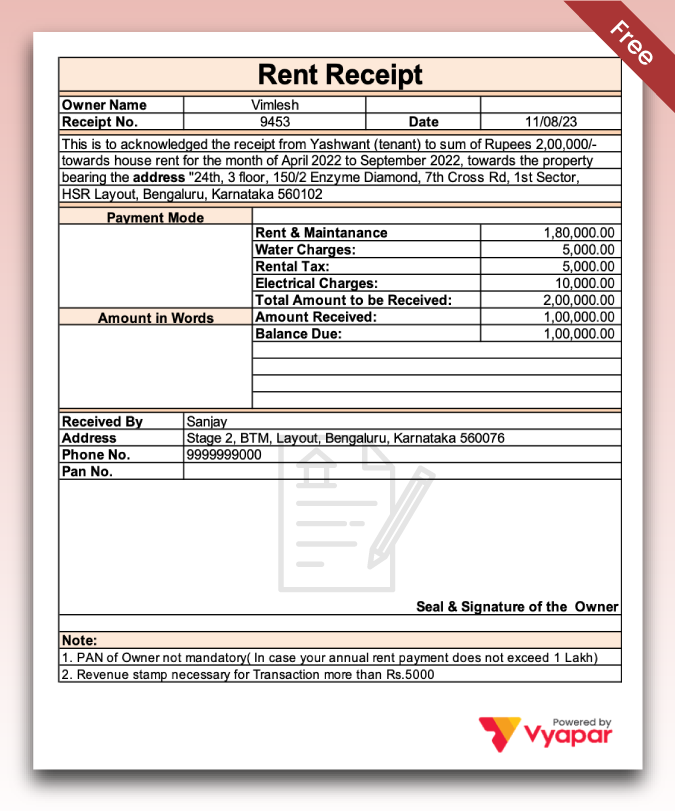

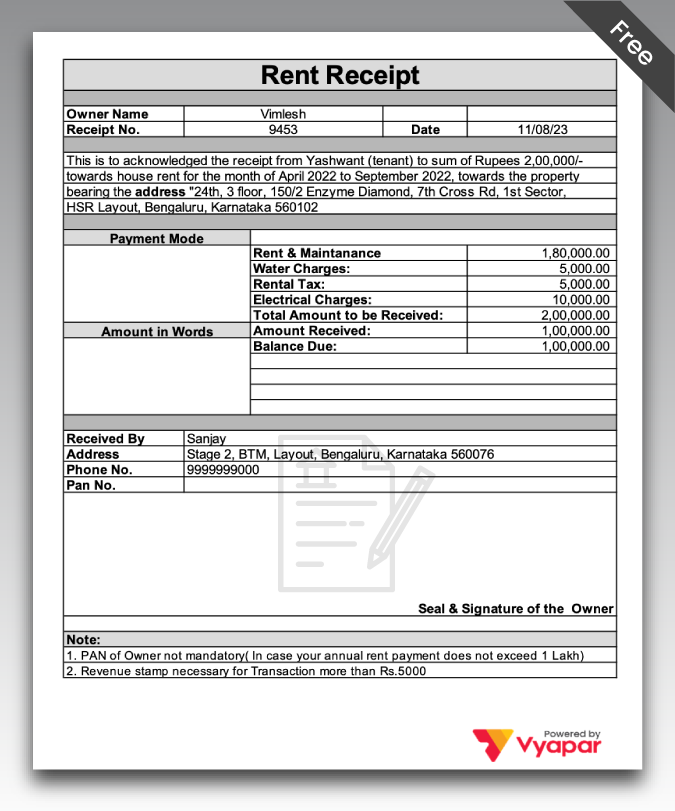

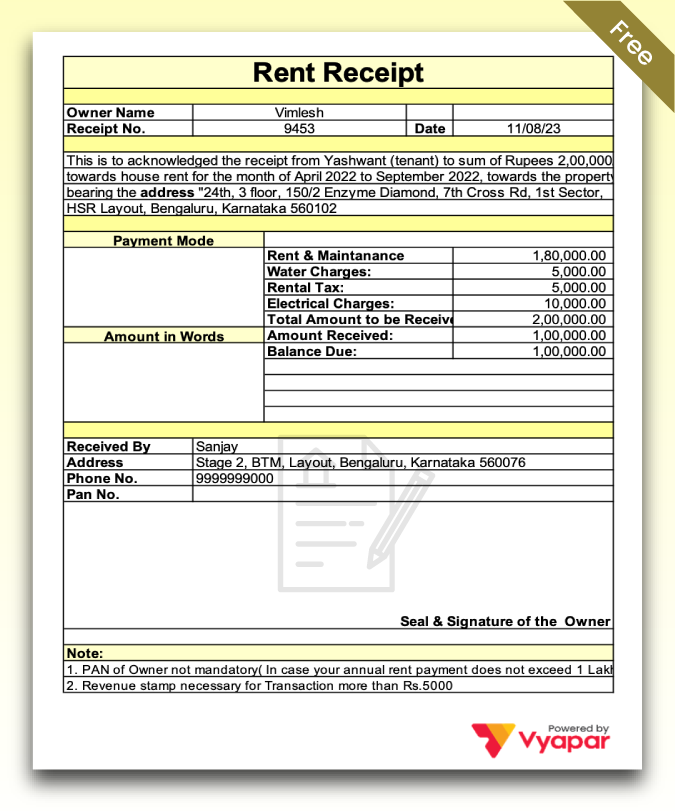

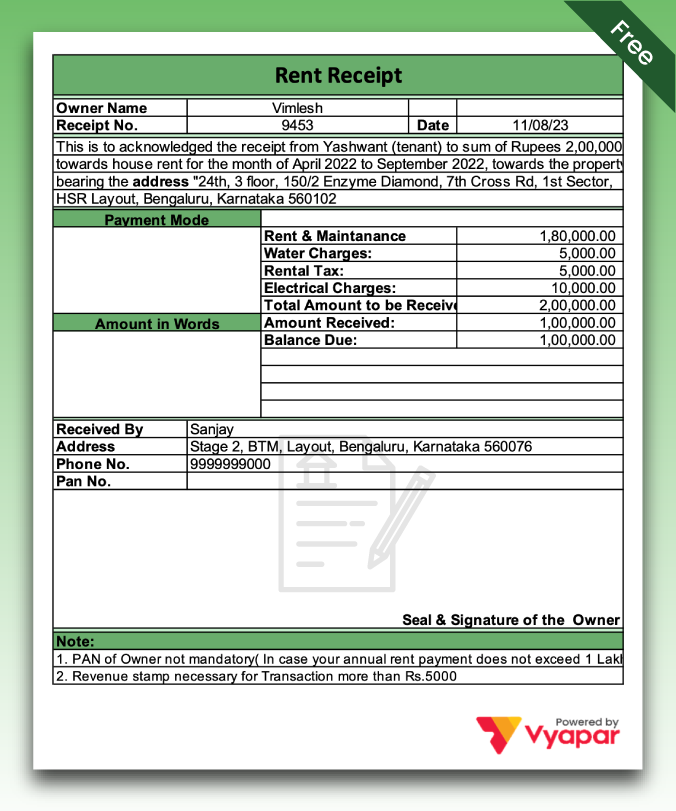

Components of a Valid Rent Receipt

To ensure compliance with the Income Tax Act of 1961, every rent receipt must include the following components:

Tenant’s Name: The rent receipt should prominently feature the full name of the tenant.

Landlord’s Name: Similarly, the complete name of the landlord must be provided on the rent receipt.

Payment Amount: Both in numerical and written form, the exact rent amount paid to the landlord should be clearly stated.

Payment Date: The date and time of the payment must be documented for accurate record-keeping.

Period of Rent: Details regarding the duration for which the rent is being paid should be specified, aligning with the terms of the rental agreement.

Address of the Property: The complete address of the rented property needs to be included to avoid any confusion between the involved parties.

Ensuring that these elements are present on each rent receipt guarantees adherence to the legal requirements outlined in the Income Tax Act of 1961.

Rent Receipt Format For Seamless Tax Exemption

As previously commented, salaried employees residing in rented accommodation are required to furnish a rent receipt to avail themselves of tax benefits under the HRA.

This receipt serves as legally valid evidence of their rental expenses. Therefore, it is imperative to issue the rent receipt in an appropriate format. Opting for the rent receipt format in Word can ensure a smooth process.

Sticking to this format entails comprehending the key elements of a valid rent receipt. These components are indispensable and must not be overlooked when creating a rent receipt.

Rent Receipt Template

A rent receipt template serves as a form enabling tenants to mark their rent as paid on a monthly basis. This template proves particularly useful in instances where rent payments are made in cash. Given the lack of a formal payment record for cash transactions, utilizing such a template becomes essential.

It’s crucial to highlight that the template should only be provided after the tenant has made the rent payment and the landlord has received the funds. Additionally, the form can be filled out immediately upon completing the rent payment, with details of the payment mode noted down.

Having easy access to a rent receipt format in Word is vital for the swift completion of details. This facilitates efficient documentation of rent payments. Moreover, the rent receipt enables tenants to avail themselves of the tax benefits provided under the House Rent Allowance (HRA).

How Does a Rent Receipt Work?

Rent Payment Process: According to the date mentioned in the rent agreement, the renter or tenant submits the rent to the landlord on the specified date. Upon receiving the payment, the landlord proceeds to generate the rent receipt, detailing the amount paid and the duration of the rental period.

Landlord’s Verification: Subsequently, the landlord meticulously reviews the details outlined in the rent receipt, seeking validation from the tenant. Following confirmation, the landlord affirms the rent receipt by appending their signature, thus verifying the completion of the rent payment.

Receipt Storage: It becomes the tenant’s responsibility to securely store the rent receipt. This document holds significant importance, particularly in scenarios where the landlord disputes non-payment of rent. Furthermore, these rent receipts serve as essential documentation for claiming tax benefits under the House Rent Allowance.

Benefits of Using a Rent Receipt

Rent receipts come in handy in many situations of confusion and non-compliance with rules mentioned in a rent agreement. Accordingly, it is beneficial for both parties, that is, The Landlord and the Tenant.

Advantages For the Landlord

Sign Of Professionalism: A rent receipt in the correct format helps a landlord or their property manager highlight their professional character in the market. It is said that you sell what you show. Will you like it if you buy something from a supermarket and do not receive a receipt for the same? No, right.

Similarly, a rent receipt gives the tenant proof that a proper record has been kept and that the money is going to the right place. So, in this way, an image of professionalism is maintained.

Proper Record Keeping: A rent receipt format in Word comes in handy when the landlord wants to keep a record of payments. There can be cases where the client pays the rent via cash, money order, or cheque. In these cases, there are no chances to track these payments.

Although the landlord might be able to keep a record through the bank statements of every month, a rent receipt is a more solid and simple formula to do the same. Through a rent receipt format in Word, record keeping can be accomplished easily, which can be later provided as proof in any circumstance.

Relation Building: Rent receipts formats are helpful at many different levels. The fact that it is used to create a history of payments with both parties is an added advantage of the document.

In cases where the tenant loses their copy of the rent receipts, the landlord might help them by providing their copy so that the tenant can pursue the tax benefits they are looking forward to availing.

Dispute Resolution: Maintenance of a record of rent receipts ensures that there are no discrepancies regarding the rent between both parties. It also helps the landlord and the tenant when disputes regarding the same matter arise.

For example, there can be a situation where the tenant claims to have paid the rent on time, but the landlord has received it late. Here, a return record as a rent receipt can help prevent the dispute from escalating.

However, this can’t be used in cases where a cheque has been issued for the payment of rent. If a bad cheque has been written, or there are insufficient funds in the tenant’s account, the landlord can keep a copy of the bounced cheques to prove his innocence.

Advantages For The Tenant

For Protection: Today, adulting is also associated with living in rented places. It has become a widespread practice now. But with the perks, there are cons to this idea too.

There are situations where the agreements between the tenant and the landlord turn hostile because of the landlords’ unreasonable restrictions. In many spaces, the landlords also deny the tenants from providing a rent receipt. It saves them from paying more taxes on their income from the property.

That is why a rent receipt is the one solution for the tenants, which can save them from falling into the traps set up by bad landlords.

For the Maintenance of a Clear History: Recording payments helps in maintaining a trail that can be sought out later. The rent receipts kept with the tenant help them in circumstances where they decide to move out and change places. It also comes in handy when tenants apply for a home loan. Without keeping a record in the form of these rent receipts, it becomes tough for the tenant to describe any rent payment.

It also serves as proof of credibility, which can be presented in front of any other property owner you want to take up on rent.

For Availing Tax Concessions: As mentioned earlier, employers are bound to provide their employees living in rented accommodations with the HRA or House Rent Allowance.

Although the amount of tax benefits you can have is not fixed, there are certain conditions you need to fulfill to fit in this criteria, which have been mentioned beforehand.